There’s been a few times I’ve shied away from trying to figure out Amazon’s impact on the device market, particularly when it came down to ancillary sales like insurance. It’s not of course, but to me it seems entirely random as to when I’m presented an insurance offer alongside a device purchase. Even today, this mobile phone could be insured with protectyourbubble, that TV with Acasta Insurance, the Galaxy S25 had no insurance option, but the S24 was back with protectyourbubble again. So whenever anyone asked me to include Amazon in a research exercise, I’ve politely swerved and marked it for the future.

However, in last month’s CCS Insight webinar, there was a data point which was enough to begin to build a better picture of device distribution in the UK. Now, there’s a few people out there that know precisely how many devices Amazon sell, but they’re either employed by Amazon or they are bound by strict non-disclosure agreements. So, it’s less straightforward for us mere Athenians and with all the usual caveats, here’s my current thinking.

Some of the better (free) data for examining device sales and market share in the UK has come from the UK Government’s Competition and Markets Authority (CMA) 2021-2022 market study into Mobile Ecosystems1. There are, however, significant redactions on the grounds of confidentiality, meaning assumptions are still required. As a side note, the CMA have just announced another relevant investigation including Apple and Google2. I’ll bet they can’t wait, maintaining an ‘opoly is bloody hard work.

Cracking the Numbers

According to the CMA report, the total value of smartphones shipped into the UK in 2021 was £11.7 billion. I’m assuming flat sales since then. Note that's the "sell-in" figure and for actual sales to consumers, the CMA suggests a reduction of up to 20%, bringing us to around £9.4 billion.

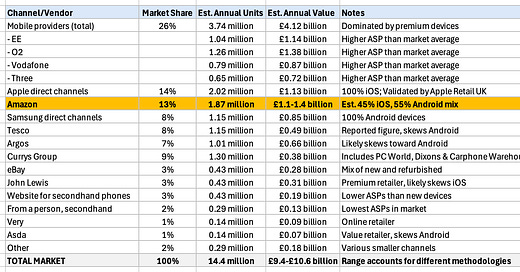

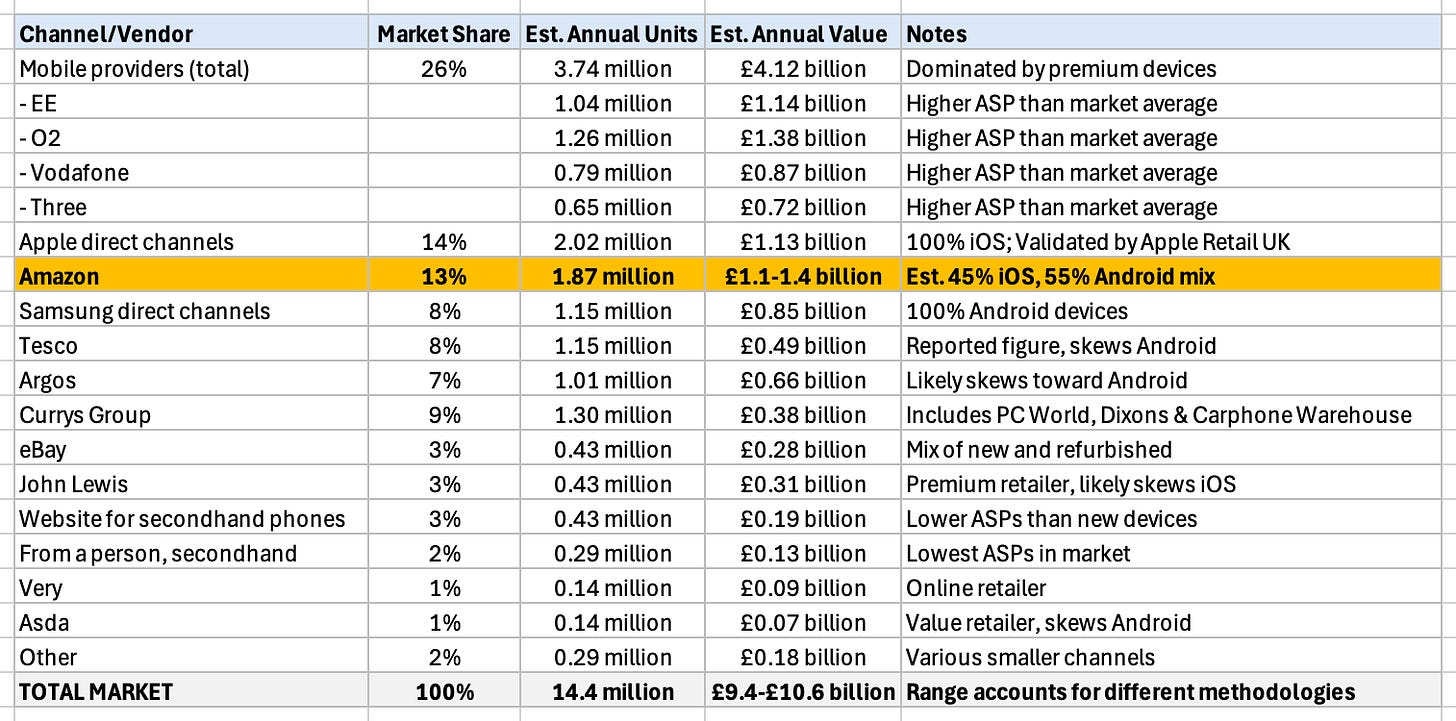

CCS Insight's data shows Amazon with a 13% share of the UK mobile device market by volume. This puts them in third place behind mobile providers (26%) and Apple's direct channels (14%). However, my own research suggests mobile providers have a larger slice (39%), with Apple and Samsung's direct channels accounting for 23% combined.

Using the CMA figures as a baseline and triangulating with reported figures from key retailers’ filed accounts, I estimate Amazon sells around 1.87 million smartphones annually in the UK, translating to roughly £1.1-1.4 billion in value. This variation reflects uncertainty about Amazon's exact mix of iOS and Android devices – though I suspect they skew slightly more toward Android than the market average.

To put this in perspective, Tesco (with 8% market share) reported mobile phone sales of £488.6 million, while Apple Retail UK's iPhone revenue was approximately £1.13 billion for the year ended September 2023. These figures help validate the Amazon estimate.

The Full Picture

Using CCS Insight’s full vendor / channel split from the webinar presentation would give us the following UK smartphone market breakdown:

Why Amazon Matters

I acknowledge this is a starting point and welcome any refinements you can offer. Still, this suggests Amazon's share of the UK smartphone market is significant with a couple of key implications.

Trade-in and Circular Economy: Amazon’s trade-in potential and therefore their potential supply of refurbished or secondhand devices is significant. Whilst it’s unclear how the current programme, run by Ingram Micro, is performing, it’s likely they are one of the few companies with the capacity to deal with the current volume and future scale. If you were to take the 20% GSMA take-back target for carriers as a benchmark, Amazon’s trade-in could be 374k a year or a tad over 31k per month.

Whilst mobile carriers chase the (voluntary) GSMA target, OEMs are beginning to up their trade-in games as well. As more consumers opt for a refurbished device, new sales must surely be cannibalised to some extent3. Amazon’s customer loyalty and scale, combined with their customer data and logistics capability means the carriers and OEMs are going to have to fight pretty hard for that trade-in, which is likely going to be reflected in pricing in which Amazon has form.

Disruption of Established Service Ecosystems: Amazon's market share represents close to 2 million devices annually that mostly bypass the traditional carrier/retailer-insurance-repair ecosystem. Insurance providers and repair networks who have built profitable relationships with mobile carriers and specialist retailers are effectively locked out of this segment. It’s pretty challenging to get a handle on ProtectYourBubble’s Amazon performance and despite some consistency around a 10% attachment rate for the established operator insurance programmes 4, I don’t see Assurant’s direct to consumer brand hitting anything close to those rates.

Consumers’ continued migration to Amazon therefore represents a substantial and increasing revenue gap for insurers and repair networks further down the line. If we pretend that Amazon & [insert insurer name here] could attach mobile insurance at a similar rate to Telefonica, that’s an approximate £90m annual insurance programme. Not too shabby.

Peace,

sb.

Thanks for sharing the insights and figures.

I had a look at the UK "Amazon Renewed" section, is this the program that is partnered with Ingram Micro? Curous, does Amazon purchase, list and stock the devices themselves or they are providing the platform plus value-added services on the logistics and operation (from Ingram) to sellers? The partnership between Ingram and Amazon makes a lot of sense, a lot of synergies the two share.

I don't have any specific local insights on UK market and channel splits, but I think your estimate and others listed (CCS & CMA) is a good effort and seems reasonable. Generally speaking, tracking the distribution flow from sell-in, sell-thru and sell-out is very messy and difficult, this is especially true for online marketplace channels like Amazon where there are offline retailers also present. In Southeast Asia, the smartphone vendors pour a lot of resources into gaining this visibility and but still struggle for various reasons.