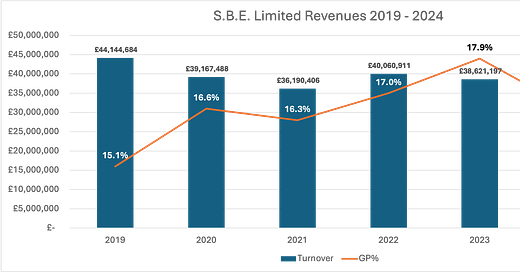

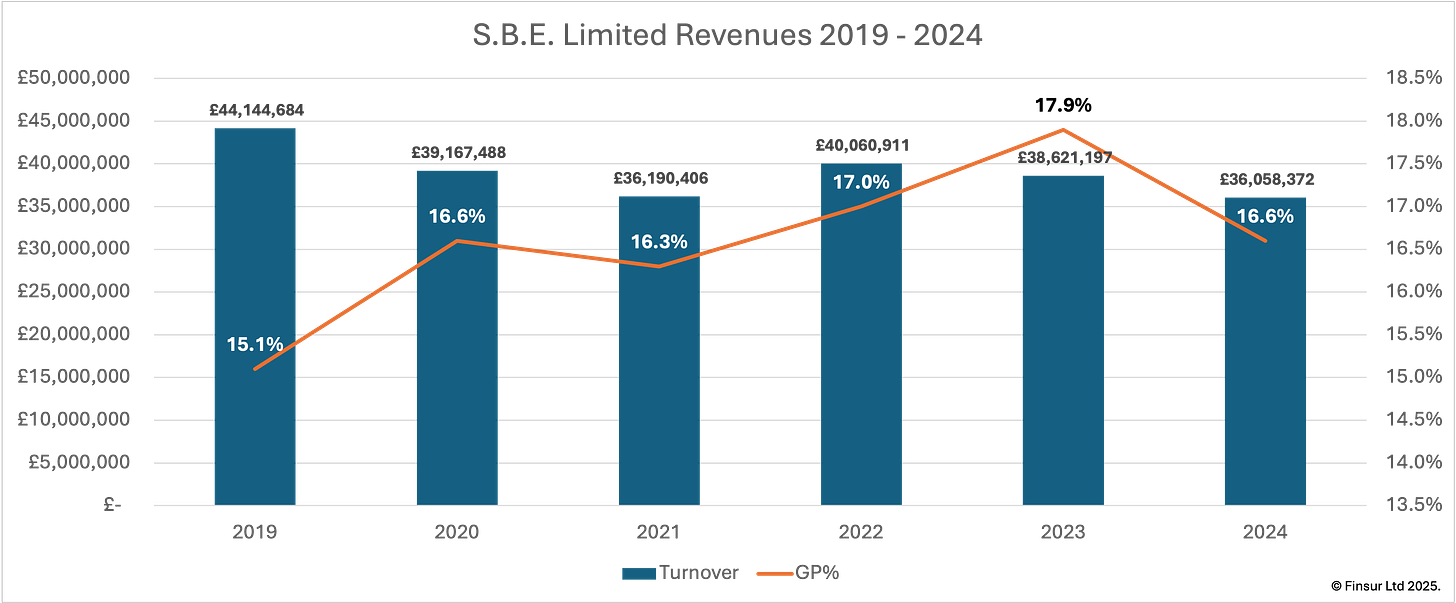

Toward the end of last year I was catching up on company filings as I continue to build out performance benchmarks for the sector. S.B.E Limited (UK) was one of the companies I covered1 and last week they filed their FY2024 accounts. So, here’s quick update.

Revenue declined for the second year in a row, down 6.6% from £38.6m in 2023 to £36.1m in 2024. Gross margin also fell back from the recent upward trend to 16.6%, down from 17.9%. Previously I reported that the 2022 - 2023 improvement in gross margin may have been down to the shifting business mix.

That may have been premature. This reversal could mean the new ventures might now be facing margin pressure as they scale or mature; the decentralised repair capability (the micro-sites in EE stores) could be proving costly to operate, impacting overall margins or; legacy business may be declining faster than new business lines can grow profitably. Without product line revenue analysis, this is a bit speculative and a combination of factors is most likely.

Unusually, and noticeably, revenue declined at the same rate in all regions (6.6%). I have no insight as to why, but this is unlikely to happen naturally. It’s possible that overall revenue decline has been allocated across all regions, which would be a bit shoddy or there are some undisclosed group transactions that made sense to someone sitting in front of a spreadsheet.

Management state that the increasing National Minimum Wage (NMW) is placing a higher burden on the cost base and I’m assuming the 10% reduction in headcount, from 320 to 288 was a partial and unfortunate response. However, it wasn’t enough to halt the continued fall in operating profit which was down 62% from £461k to £173k. A few ins and outs for interest receipts and payments, and a corporation tax payment meant the net profit was down from £415k to £157k or 62%, again. Curious.

The declining operational performance may have prompted a focus on liquidity. That, or new group treasury policy is now effective. Cash generated from operations improved substantially from -£526k last year to £1.82m. There was an 18% reduction in stocks and a 16% reduction in debtors, both of which would have had a positive impact on the end of year position.

Unfortunately, the additional cash seems to have gone back up to the parent rather than funding any investment at the entity level. Whilst, S.B.E. are keen to point out their significant investment in AI and ML, how significant is unclear. Capital expenditure figures only amounted to £67k and fixed assets were down to £388k a drop of 27.4% on the prior year. This makes the “AI-based diagnostic solution for direct repairs leveraging historical data to predict repair outcomes and optimize service delivery”, seem like an obligation rather than a competitive development.

In the last report I highlighted S.B.E.’s diversification strategy stemming from opportunities brought along by the new owner and, whilst the latest filing mentions plenty of opportunity: customer premises equipment; the energy sector; telecoms towers; medical equipment and; the connected and electric vehicle market, the truth is that growth synergies are far harder to realise than cost synergies and if you were positive about them, those employee cuts would have been delayed, surely.

Management's nod to sector consolidation in their filing “The industry is witnessing increased consolidation, with insurance providers acquiring repair capabilities and OEMs managing high-level repairs in-house” is presented as a risk creating “additional pressure on the business.” Whilst regular readers will know this fits with my ongoing sector narrative, I'm inclined to view consolidation as an opportunity rather than a threat.

On the basis of these results: declining revenues, falling margins, reduced headcount, and minimal investment despite wide ambition, it seems like a necessary opportunity at that. With cash apparently flowing upward to the parent rather than funding genuine competitive development, perhaps there are alternative strategic options for the SBE (UK) entity?

Peace,

sb.