November items of interest that are on the periphery or were’t quite meaty enough to write a single post about (yet) in include:

AO World released their half year trading update earlier this week1. I was less interested in the trading results and more interested in what they had to say about the MusicMagpie acquisition. However, there were a few useful market notes. AO Mobile continues to find conditions challenging with a decline in the overall contract handset market of 11.4% and a consequent revenue decline of 12.7%. There was also milestone progress from their Major Domestic Appliance recycling centre processing their seven millionth appliance. The centre is getting additional investment to assist in their circular economy ambitions. Anyway, back to MusicMagpie. The deal seems done, bar any courtroom shouting on 10th December and the only note was that the “acquisition will augment our capability and value capture in the mobile and consumer technology categories as well as improving our ESG credentials”. I’ll buy into the first bit. The last bit is lazy2.

At some point soon, I will be attempting to dive into Bolttech’s performance and valuation. After closing their Series A round in July 21 with a $1bn valuation and Series B just 15-months later at a $1.5bn valuation, you don’t need to speculate too hard at the motivation for a venture debt round of $50m some 25-months after that3. With current tech valuations being realistic suppressed, the raise should give them enough runway until the probability of a down-round has all but gone or the IPO rumours resurface4. As a reminder, Bolttech have complemented variable European organic growth with the acquisitions of Digital Care in Poland just over a year ago5 and i-surance in Germany in 20216.

In my MTR Group Research Update7 a few weeks ago, I suggested it might be time for them to find them a new home. It was no surprise therefore that DCC has put Exertis up for sale as they focus on their energy business8. For now I’m going to assume the sale will include the MTR Group, but there’s no reason why it should. The legal entity was never absorbed into Exertis and it’s a minority part of the overall business, so it’s not too hard to imagine them selling it separately. It’s certainly got some good things going for it, including the retail customer base. CTDI makes sense as a destination, or one of the larger insurers. My recent Foxway Research Update9 suggests their acquisition habit is on hold until 2026, which leaves Back Market (see below) and Bolttech (see above) as alternative suitors.

Arma Karma, the gadget insurance start up intending to kick “…traditional, old, boring insurance to the curb…” appear to have been saved by Bspoke Insurance Group Limited (ex UK General Insurance). The acquisitive MGA became a person with significant control according to Companies House filings10 earlier this month.

Tesco Mobile and Assurant (re)launched their trade-in partnership11. The relationship was originally announced back in January 202312. According to IDC13 the average trade-in rate is 17% which, according to my UK Device Insurance study, means they could be processing up to 120,000 devices per year. I think the 17% might be overstating it a bit, but either way it’s not too shabby.

Currys Retail Limited (the old Carphone Warehouse entity) filed their latest accounts made up to the end of April 2024. I know the results were released earlier this year, but I’ve picked up the entity filing. Total device sales grew from £383m to £510m and commissions (network and insurance) declined from £245.7m to £149m. If I pretend for a moment the device sales are all phones, which they’re not, it could mean unit sales of just under 850k14. Ignoring the timing difference, there’s a stark contrast here with AO Mobile (above), although, Currys may have an advantage in keeping their mobile device sales going by being able to offer competitively priced network connections via their IDMobile MVNO.

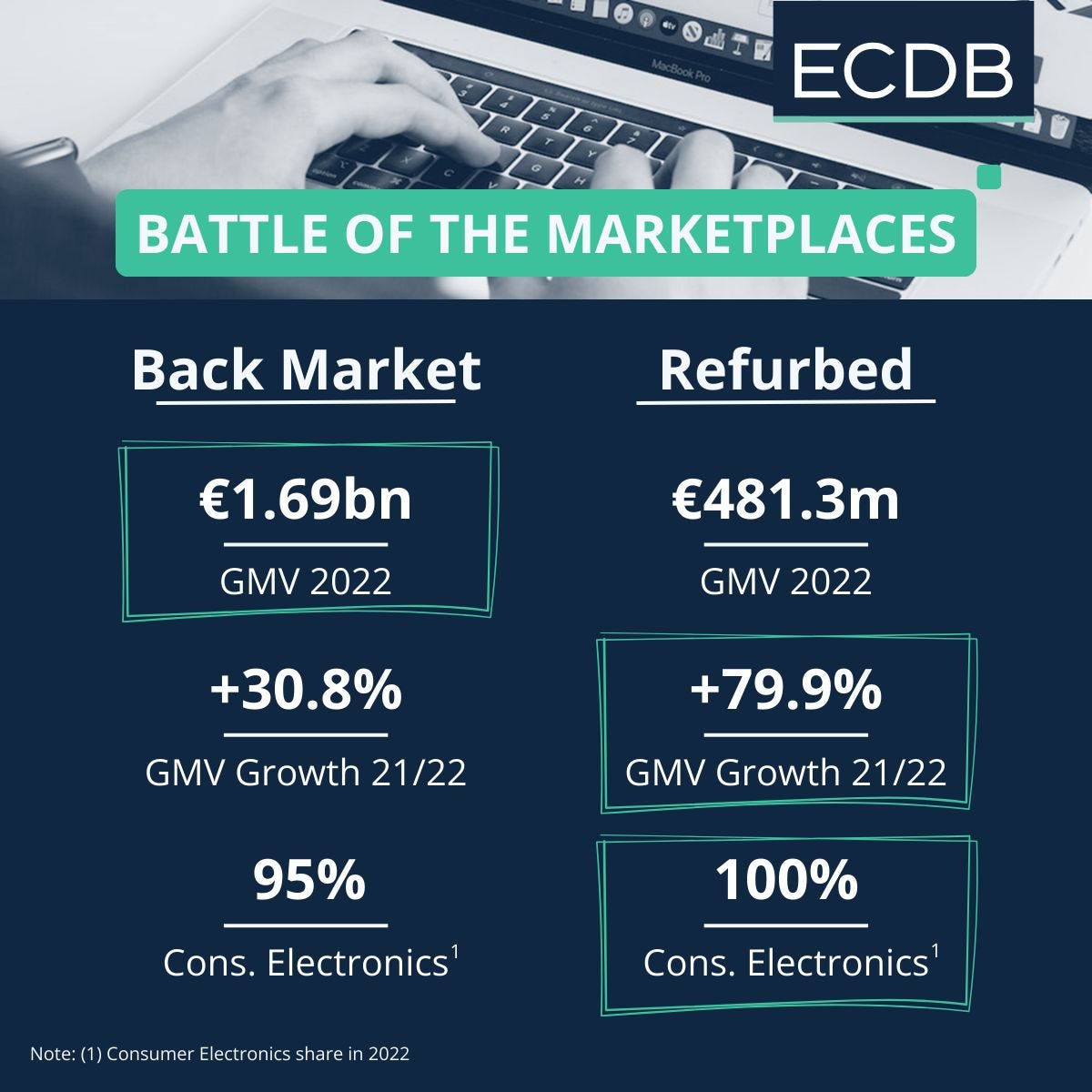

It’s been a busy month for Back Market. Pieter Waasdorp’s excellent Secondary Market News shed some much needed light on their financials as they switch from revenue to profit focus15. Which, at that ridiculous Series E over valuation16, is long overdue. They also shared their GMV values17 with ECDB to beat up a competitor and then started a public spat with Cdiscount, accusing them of not following up on potential VAT fraud18. Like abnormally low prices never appeared in their buy box. Pot. Kettle. Black. Seriously, feel free to hit me up in the comments or dm me if you can point me in the right direction to any of their actual financial information. All I get when looking at their declared registry is “accounts not filed”19 since 2017. I must be looking in the wrong place or there’s another company sitting above Jung SAS into which accounts are consolidated. I’d love to review the financial performance of a company that has considerable influence over the European secondary market, especially one indicating acquisitions might be on the way. Just on that valuation by the way, let’s say as a market-place they earn 15% of the GMV, on €1.69bn that’s €250m, that’s 21x revenue (EUR/USD 1.05) and if they earn less than 15% then wtaf.

The Vodafone - Three tie-up stepped closer to reality with the provisional view the merger should go ahead subject to certain remedies being in place20. As a reminder, from a device/insurance perspective, my research suggests the combined entity will be selling over 2.6m units per year. Alongside that will be the largest insurance and possibly trade-in programmes in the UK. Ingram Micro currently run the trade-in programmes for both and, I’m sure the telcos will want to share any efficiencies down the line. More troublesome will be the insurance programmes currently managed by Assurant and SquareTrade. Assurant’s anticipated advantage in working with Vodafone’s Malta based captive is entirely negated by SquareTrade’s experience working in the same jurisdiction with an excellent European record. All to play for.

Northladder, purveyor of “The world’s most advanced Trade-in solution” and recent acquirer of Renewd, has raised $10m at Series B from Tali Ventures (stc), Dutch Founders Fund and CE-Ventures in a follow-on round21. The first round raised $10m in May 2022 and Series A raised $5m in February 2021. Funds will be used to continue market expansion and the development of their aforementioned trade-in platform. I’ve been trying to find my way around the Dubai company registry to get more detail, if that’s even available, but I’ve come up short. I’ll give it another go soon.

Peace.

sb.

Taken from Francisco Jeronimo’s IDC presentation at the Circular Summit in October 2024.

This is on the basis of an Apple / Android market value split of 75%/25% and a weighted average net device value of £823/£333