It was disappointing to read that electronic waste was not included in the UK government’s initial list of priority sectors1. Without having the information on which DEFRA’s Circularity Taskforce made their decision, I can only assume that e-waste is less of an issue than chemicals and plastics, construction, textiles, transport, and agri-food. That’s despite the UK having the second-highest e-waste per capita, globally, with the situation probably getting worse2. Alternatively, the taskforce might be waiting for the wider producer responsibilities3 to come into effect this year before making any additional recommendations. Thanks to Fiona Dear at the Restart Project for highlighting this.

Highlighting DEFRA’s miss, according to their new research, VMO2 announced that Brits could earn on average £638 per household from their unwanted tech4. Despite 65% of people saying they understand the impact of throwing electronics in the bin, 79% admit to doing it with an estimated 92 million devices having been thrown out in the last 5-years. Unsurprising therefore that the only carrier mentioning trade-in, for example, front and centre on their website (at the time of writing) was Vodafone. Given O2’s performance against the GSMA’s pace setting targets5, they’re going to need more than research pieces to close the gap.

I’m not 100% sure yet whether I should be covering distributors but, having kept an eye on Ingram Micro’s recent journey (see below for the latest), I felt I should probably check in on TD Synnex (‘SNX’) and, despite mobile being the smallest category in their portfolio, I think they offer an indication of general sector health. So, not great to read the share price dropped after the 2025 Q1 earnings release6 on 27th of March. Despite both the Endpoint Solutions (personal computing, mobile, accessories, etc.) and Advanced Solutions (datacentres, infrastructure, etc.) business units showing top-line growth, 5% and 3% respectively, margins contracted. Gross margins dropped to 6.87% and operating margin to 2.7%. The results triggered a 14.3% share price decline following the announcement. As of November 2024, 12% of SNX’s revenue was generated from the sale of Apple products.

I last mentioned Assurant’s iSmash in the September Round Up7. It’s difficult to tell yet if these progressive insurance service offerings (e.g. Likewize’s man-in-the-van and Assurant’s iSmash in-store service), are being asked to stand on their own two feet or are being considered as the new “cost of claim”. Self-funding feels a long way off. After injecting £2m in December, another £3.5m went in around the end of March according to the filing8. Unrelated, this follows the announcement from Reboxed that they’ve partnered with iSmash to enhance their repair service offer9.

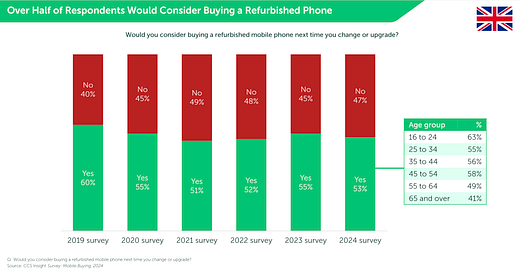

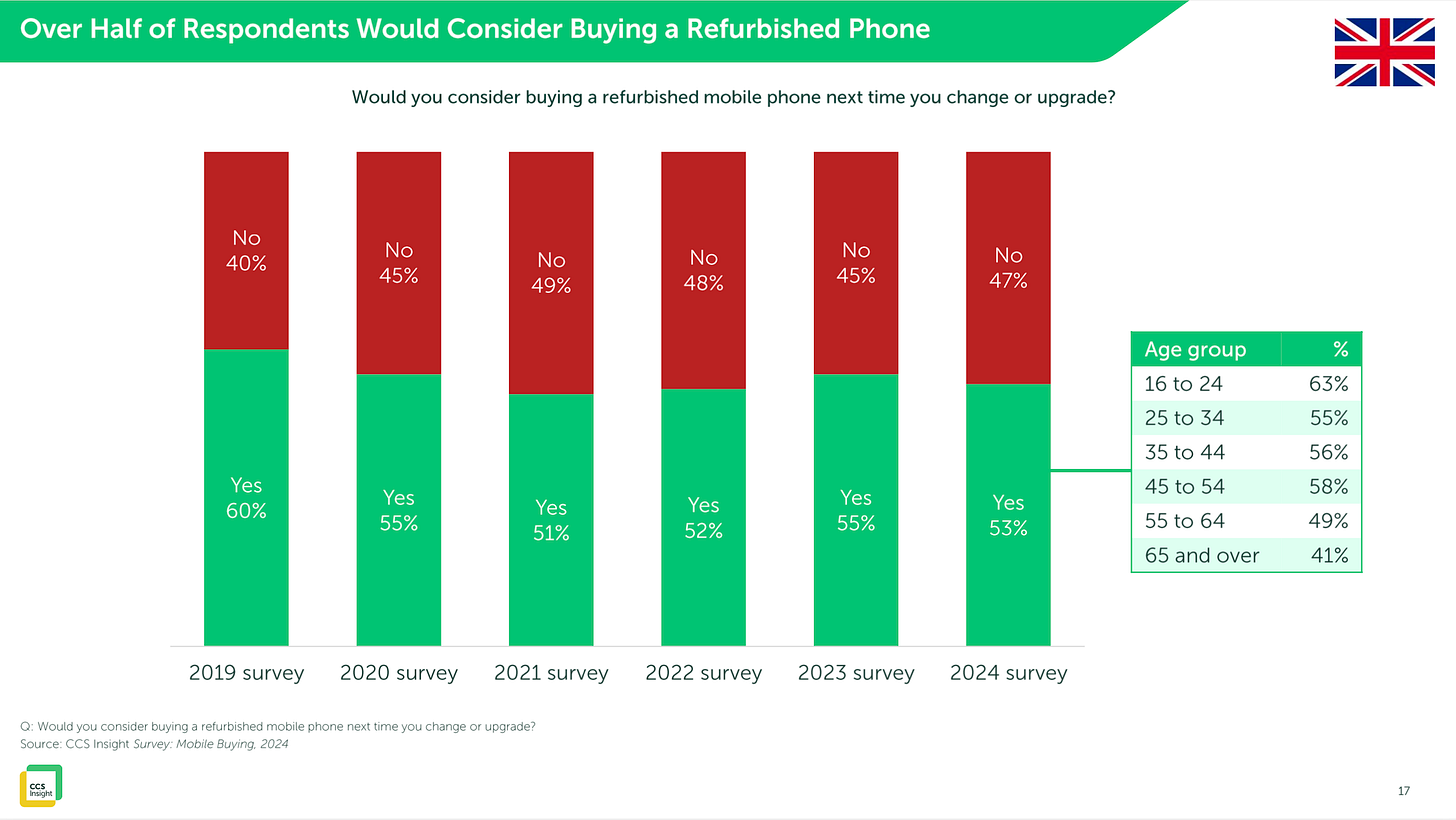

If you’ve not signed up for CCS Insight’s events including their monthly webinars, it’s probably worth your while doing so. Last month their Mobile Buying Trends update gave those of us attending some very useful data points. For me, additional confirmation that consumers are increasingly buying directly from Apple (14%) and Samsung (8%), demonstrates how well these two manufacturers are positioning themselves for increased trade-in participation. The other data point, that 53% of UK consumers have refurbished devices in their consideration set, continues to show significant upside for the sector, especially in the younger age groups that traditionally switch phones more often.

Source: CCS Insight, Mobile Buying Trends: What’s Changing and Why It Matters. (March 2025)

The opportunity was further quantified in the same CCS Insight session, which reported that 12% of current phone sales are either refurbished (6%) or secondhand (6%). Additionally, I picked up an IDC data snippet from Pieter Waasdorp’s Secondary Market News, that suggested that by 2029, 17% of device sales will be used or refurbished, up from 14% today10. My own research at the end of last year put the current UK figure at just under 16%. So, probably getting some consensus around the 14% mark. These numbers are some way below the 25% reported by GfK in their tech survey in February 202411.

Basatne, the Texas-based multi-brand distributor, refurber and recycler announced the acquisition of Cartlow, the UAE-based recommerce and sustainable device management company12. The news release highlighted Cartlow’s processing of over 1million devices and suggests some associated CO₂ prevention (see here for my view on that). No purchase value was published, although Cartlow had raised $18m from Saudi-based Alsulaiman group back in June 2022. Later in the month, Basatne published a news release highlighting a partnership with FutureDial13 and another highlighting their new robotic solution in the UAE, which from the photos and video looked suspiciously like Apkudo machines14. Expensive, but I guess that’s one way to benchmark.

Servify gets a mention, for the third month in a row. After news about the profit improvement in January and rumours of an IPO surfaced in February, this month’s instalment is the announcement of an additional $7.8m into their enduring Series-D round which opened in May 2021 (I think). That puts the round at just over $117m. Increasing their equity stake are previous investors Beenext Capital and Singularity Ventures AMC. Probably unrelated, but Servify’s UK entity seemed to be the subject of a corporate tidy up, with Service Lee Technologies Private Limited (Servify) becoming the relevant legal entity.

I wondered at the sharp drop in Ingram Micro’s share price after their fourth quarter and full year 2024 results were released at the beginning of the month. It appears that corporate memory loss, or some such, has landed them in a spot of bother with the law offices of Frank R. Cruz. According to the announcement15, the full year results were materially impacted by two separate charges including $9m of inventory write offs, which saw the stock price fall over 5.5% on the day. I’m assuming the case will be around these items not being disclosed during the IPO. At least one investment bank, Jefferies, cut their price target16, whilst Bank of America maintained their price target17, ensuring that any retail investors will be entirely confounded about what to do with their investment.

Couple of people moves worth highlighting: John Doughty, formerly at Likewize moved across to Alchemy to head up Global Partnerships18. Likewize replaced their CEO with Ryan O’Hara19 who had been appointed as a board director a few months earlier and Bolttech announced that they have appointed Dragon Fund’s Chief Investment Officer, Ridhi Chaudhary as a Non-Executive Director20, an excellent position from which to monitor their recent investment.

Finally, a sincere thank you to all the new subscribers this month and especially to those of you paying. Kids to feed, running shoes to purchase and it’s getting closer to the time of year when I start drinking Orangina by the gallon.

Peace,

sb.