Last week I mentioned that Foxway's Q4 results had landed1, and that my revenue predictions proved overly optimistic. Here’s the more detailed update I promised.

Performance

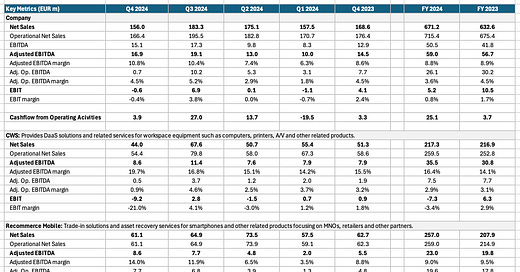

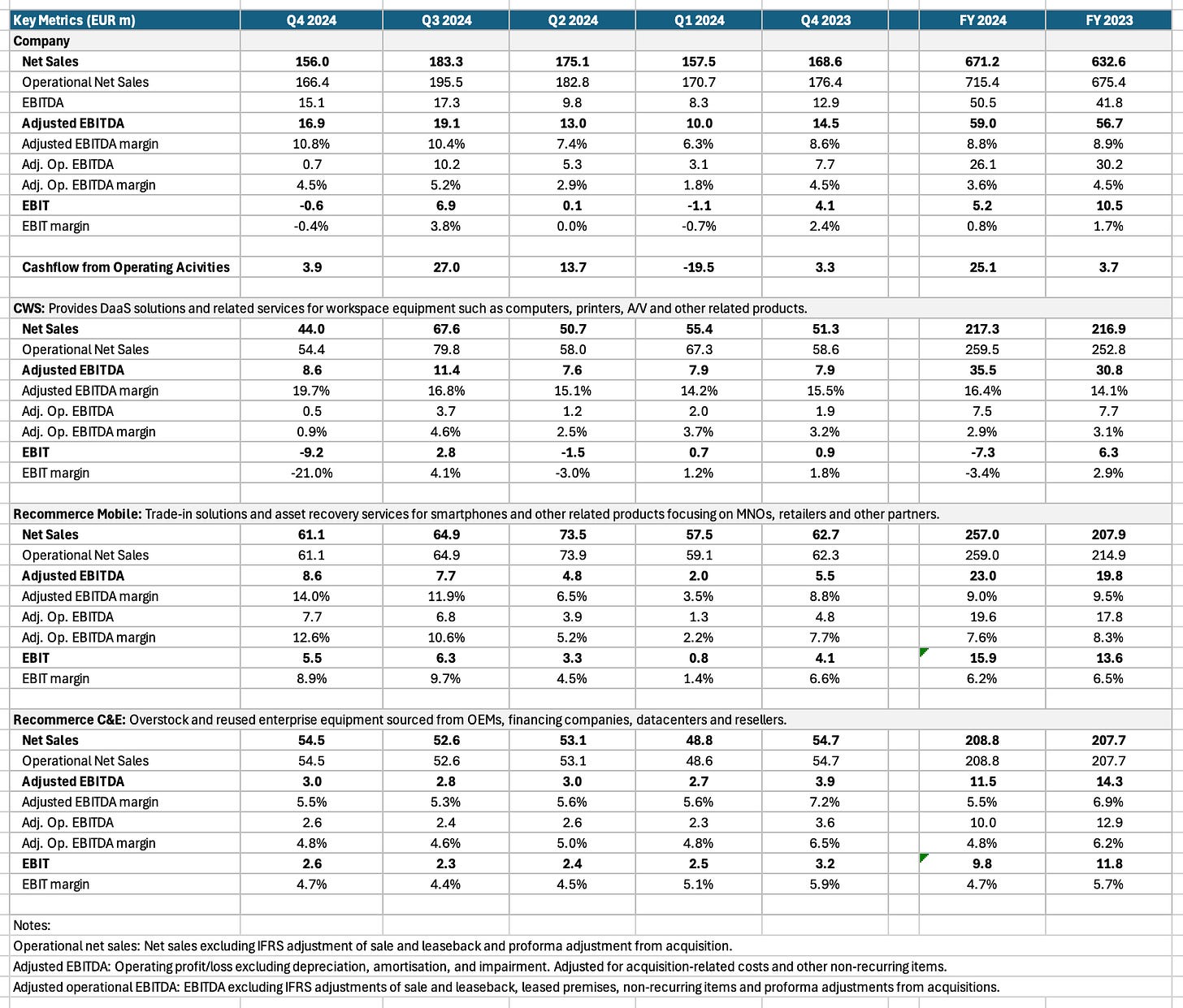

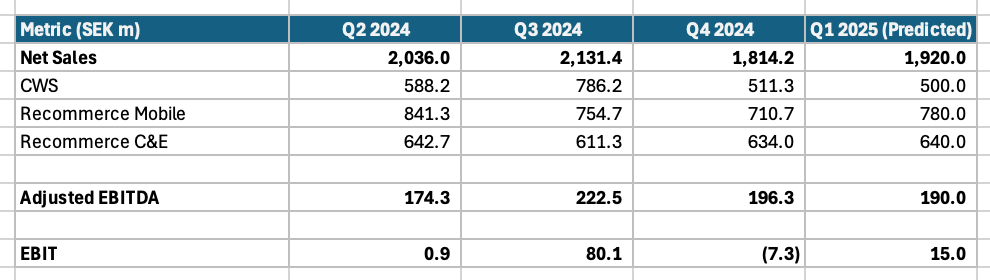

Foxway's Q4 results confirmed the segment-level volatility that I’d previously highlighted. Company Net Sales hit SEK 1,814.2m (€156m) in the quarter declining 14.9% compared to Q3 and 7.5% compared to Q4 2023. For the full year, revenue totalled SEK 7,804.6m (€671.2m), which represented 6.1% annual growth despite the underwhelming Q4.

The Q4 downturn wasn't uniform across business units:

CWS suffered the largest decline in revenues from SEK 786.2m (€67.6m) in Q3 2024 to SEK 511.3m (€44.0m) in Q4, a 35% drop. Management state this was primarily due to losing a significant Swedish customer which accounted for about 65% of the drop together with broader market delays in IT investments across Europe. It was also a 14.2% decline from Q4 2023, although the was a full year gain of 0.2% due to stronger performance in Q1 and Q3 2024.

Recommerce Mobile demonstrated relative resilience with a 5.8% decline from SEK 754.7m (€64.9m) to SEK 710.7m (€61.1m). The drop was a modest 2.5% from the same quater last year, but overall a 23.6% gain from SEK 2,417.9 (€207.9m) to SEK 2,988.6m (€257m).

Recommerce C&E grew 3.7% from SEK 611.3m (€52.6m) in Q3 2024 to SEK 634.0m (€54.5m) which represented a small 0.3% decline on the same quarter last year. For the full year, revenues grew 0.5%.

From a profit perspective, company Adjusted EBITDA in Q4 2024 dropped 11.8% from Q3 2024 but grew 16.2% from the same quarter in 2023. Full year Adjusted EBITDA grew 4.1%.

Again there was significant segment volatility:

CWS Adjusted EBITDA fell 23.9% from SEK 132m (€11.4m) in Q3 2024 to SEK 100.5 (€8.6m) in Q4. However, this was an 8.9% jump from the same quarter last year and for the full year a 15.4% increase from SEK 558.2m (€30.8m) to SEK 413.2m (€35.5m). Clearly the client loss was unexpected and as management are holding out for a return to IT spend, this might be a blip in an otherwise solid year.

In Recommerce Mobile Adjusted EBITDA grew 10.9% from SEK 89.7m (€7.7m) in Q3 2024 to SEK 99.5m (€8.6m) in Q4 2024. This was a significant increase of 55.2% on the same quarter last year and overall a 16.3% increase for the full year. This pushed the Adjusted EBITDA margin to a healthier 14.0% on the back of strong demand, cost control, automation and whilst the “tight sourcing market” may have acted as a constraint on revenue, it also held up the other side of the income statement.

Recommerce C&E: Adjusted EBITDA grew 6.4% from Q3 to Q4 but fell 23.7% on the same quarter last year from SEK 45.5m (€3.9m) in Q4 2023 to SEK 34.7m (€3.0). For the full year, Recommerce C&E is lagging the other segments with an overall YoY drop of 19.7% and Adjusted EBITDA Margin compressed to 5.5% as persistent low overstock volumes continued to pressure profitability.

Financial Position

Despite Q4's revenue setback, Foxway's adjusted EBITDA improved to SEK 196.3m (€16.9m) from SEK 171.7m (€14.8m) in Q4 2023, expanding margins to 10.8%. After finance costs, however, the company reported an operating loss of SEK 7.3m (€0.6m), compared to a SEK 47.3m (€4.1m) profit in Q4 2023.

The balance sheet shows modest deterioration since December 2023:

Net debt increased to SEK 2,815.8m (€242.2m) from SEK 2,397.7m (€206.2m), pushing the debt ratio to 42.3% from 37.9%, further constraining any major acquisition activity.

Cash position declined to SEK 503.6m (€43.3m) from SEK 722.1m (€62.1m).

The equity ratio remained stable at 46%, suggesting the group continues to maintain adequate capital structure despite increased leverage.

Positively, operating cash flow for the year reached SEK 292.1m (€25.1m), so despite market challenges, the underlying business remains cash generative. Always good news.

Conclusions & Outlook

You don’t have to read to far into CEO Patrick Höijer’s year-end comments to figure out that Q4 was tough and not just financially. “Eventful” and “pivotal” hardly need Turing’s brain to decipher. Whilst management consider Foxway’s diversified portfolio a hedge against the challenging market, it wasn’t quite diversified enough to fully mitigate the sector environment last year.

Looking forward to 2025 and further to 2028, management appear to have put some effort into their “value creation plan” as a guide to their execution. They offer clarity on “Where to play”, and we’ll see if their “How to win” stacks up this time next year.

The focus appears to be on organic growth with CWS marked for expansion outside of the Nordics. This is going to be tough. There are large and experienced competitors in this segment, especially the leasing behemoths. So, whilst market development may be complemented by selective acquisitions, anything significant is going to require additional equity contributions from investors given current leverage levels, unless operational performance improves dramatically. On the other hand management noted that incoming Windows 11 may prompt those delaying investments to restart IT purchasing.

Some hope is being pinned on Samsung's Galaxy S25 launch driving strong mobile trade-in performance in Q1 2025, bolstering the Recommerce Mobile segment. I’m less convinced that any phone launch is the vanguard of a super cycle these days, but there is undoubtedly a core user base that will want to upgrade to the latest version. The automation announced last quarter will have a full year to make a difference as more devices get pushed through the (Apkudo) machines. If the 420k devices traded in from MediaMarkt last year are anything to go by, the business case is going to get a decent test and should become clearer towards the end of the year.

I probably see more headwinds with Recommerce C&E. Low overstock volumes have been an issue throughout 2024. Management suggested Q1 is showing a glimmer of improvement, but I’m struggling to see that OEMs and financing firms are going to be over producing or over buying again anytime soon.

I should have probably learned my lesson last time, but just for fun and please do not consider this to be investment advice of any sort whatsoever:

Rationale:

CWS will continue to face headwinds from delayed IT investments and the impact of the lost Swedish customer

Recommerce Mobile getting a Samsung shove with otherwise normal device refresh cycles contributing modest growth

Recommerce C&E likely to maintain current performance with marginal improvement as market conditions stabilise

Continued benefits from cost reduction program implemented throughout 2024

Finally, a thanks to management for their clarity and transparency in reporting. The webcast was an added bonus. See you in May for the next instalment…

Peace,

sb.

https://www.foxway.com/wp-content/uploads/2025/03/foxway-year-end-report-2024.pdf