Digital marketplaces have established themselves as an important enabler within the consumer electronics circular economy. Whether businesses buying and selling products directly or matching individual sellers and buyers, extending use phases is a key process in combating the ever increasing WEEE problem1.

But, it’s not all unicorns and rainbows. Many consumers value the price discount over the environmental benefit2 which has rapidly driven the market toward price-based competition. This usually only helps those with the deepest pockets and hinders those trying to reinvest for the longer term. Added to that, recent mudslinging over (an apparent lack of) VAT checks3 and naval gazing over disparate grading systems are unhelpful distractions for a sector that should be riding a wave4.

As always, I’m upfront with the challenges of analysis. Some of the largest operators in the organised space sit conveniently behind “accounts not filed” notices. Non-specialist marketplaces don’t publish category data and the unorganised space (including C2C) is pretty much impossible to get a handle on without large scale primary research. What I can do though, is bring together the available data and we can go from there.

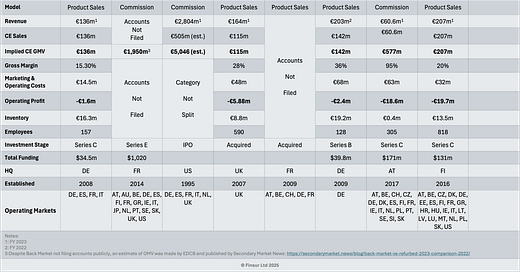

Financial & Operating Data

The table below includes a number of data points for some of the major refurbished device sellers or marketplaces operating in Europe and the UK. Feel free to ping me any major omissions and I’ll happily extend the analysis. Note there’s a bit of a mix of FY2022 and FY2023, but, it will have to do for now.

I’ve chosen to include ebay at the summary level, partly because Statista provides an estimate that 18%5 of revenue comes from Consumer Electronics which gives us another data point for comparison. And, despite Back Market keeping their accounts secret, EDCB magicked up a GMV estimate which I picked up on Pieter Waasdorp’s secondarymarket news.

Besides ebay, and without having the French data, most obviously, there’s plenty of revenue and a distinct lack of profit. Now, I could reasonably argue with myself that profit lags revenue by x years and that VC cash will, amongst other things, allow that lag to be extended based on the size of the future prize. But, excluding ebay, the average age of the companies listed here is 13.2 years and even accounting for the COVID years, you would have thought they would have been in a better financial position. So, let’s have a dig around and try and understand what’s going on.

Asgoodasnew

One of the leading refurbished marketplaces headquartered in Germany, Asgoodasnew, actually appear to be on a relatively stable financial footing. They began life in 2008 and operate through two brands: WIRKAUFENS for acquiring and asgoodasnew for selling, although there is a “sell” tab on here too. The product line extends beyond mobile phones and includes tablets, laptops, digital cameras/lenses and other CE items. They operate two locations: Frankfurt (Oder) for refurbishment operations and Berlin, I assume as HQ.

Despite declining German economic performance, Asgoodasnew posted an 11% increase in sales from €122m in 2022 to €136m in 2023. 71% of the revenue comes from Germany and 29% from operations in Spain, France and Italy. This conservative approach to market development is in stark contrast to some of their peers.

Gross margin has been gradually improving over the last three years increasing from 14% in 2021 to 15.3% in 2023. However, there’s been a list of expense items in 2023 that have eaten through the improvement resulting in an overall loss of €3.2m down from a loss of €524k in 2022.

However, the main reasons for the worsening position appear to be growth related. Personnel costs increased by €1m, Other Operating Expenses increased by €2.8m including higher logistics insurance related costs, temporary rental expenses, consulting services and receivables write-off. There’s also been an increase in financing costs related to the higher working capital, however, that’s planned, with an associated increase in inventory that’s filling up the larger warehousing space. Management report additional room for expansion with the warehouse being two thirds utilised.

There’s also a separate write down of €671k related to assets in a rental pilot which has been shut down. This isn’t surprising given the significant cashflow requirements of that particular model. So, despite the tougher economic environment and the rental dent, Asgoodasnew appear to be executing on their plan.

Thinking about estimating volumes, taking a €450 average device price, and assuming 100% of sales are mobiles, gives us approximately 302k units. Perhaps a more realistic number would be 70% mobile sales, giving us almost 212k units.

Back Market

Other than the public spat and reiterating EDCB’s guess at their GMV (€1.95bn), I can shine no light on Back Market’s actual performance. Filing a certificate of non-disclosure is deliberate and I am sure they have their reasons. Regardless, I’m positive the investors will be on top of it all and will have no intention of taking it public, selling their shares to less informed investors and making it all someone else’s problem.

ebay

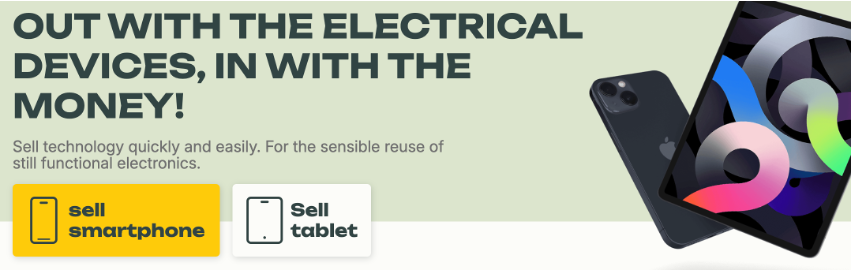

I can’t convince myself of the accuracy of the ebay data, so just consider it a loose guide. Statista claim to have some knowledge of the percentage category sales, so I’ve used this and an average of the commissions to determine an implied consumer electronics GMV of almost €5bn across the UK and Europe. Certainly the 18% of the listed revenue at almost €500m is over double anything else I have data for.

ebay straddles the unorganised (C2C) sales and the organised (B2C) sales more than the other digital marketplaces in this update. But unfortunately, there’s no published analysis to help dig further into that aspect of their business. Certainly they have been one of the main outlets for the likes of Ingram Micro (best4techuk) and Assurant (myWit) to dispose of higher end refurbished devices as part of their dynamic disposition for many years.

If the GMV number is anywhere near accurate, the removal of fees for private sellers and the general decline in sales are immaterial compared to the other digital marketplaces specialising in this sector. An interesting side point documented in the German accounts is the revenue analysis by country. I’ve added the UK as well, bar-charted for your viewing pleasure:

Music Magpie

For those of you unfamiliar with the tale, Music Magpie started out as a marketplace for buying and selling books, dvds, cds etc. It then moved into consumer electronics and went public in 2021 with a share price of 198p and a valuation over £200m. Fast forward several profit warnings and buyout rumours to October 2024 when it was finally sold to AO.com for under 10p per share. Not the case study anyone wanted to read about, but there’s more information here in my post from last October.

Recommerce

Due to their own certificate of non-disclosure, I can offer less information on Recommerce than I can on Back Market. Other than that from this release, I think the majority of shares were acquired by the United.B group (Boulanger, Electrodépot, etc) in 2022 with Bouygues Telecom and CREADEV remaining as minority investors. At the time I found this unusual. My hypothesis was that independence would have been more valuable, but I am genuinely less sure of this now, and I’ve got no data from Recommerce to determine how the (non-group) growth, for the device processing or the platform provision (CircularX), has developed since the transaction.

Rebuy

Rebuy are another large German based marketplace with subsidiaries in Poland and the UK as well as several entities in their home territory. Sales are split between consumer electronics (mainly smartphones) at approximately 70% and, media (books, movies, video games & music), the remaining 30%.

I first noticed Rebuy back in August 2021 when it was announced they had acquired High Wycombe based Technology Recycle Group (TRG). From memory, TRG appeared to have some very smart price scanning and price setting software, a little more on that later.

I think Rebuy are due to publish their FY2023 accounts within the next month or so, but for now FY2022 will have to provide the comparison. Total sales increased almost 12% from €181.5m in 2021 to €202.7m in 2022. Consumer electronic sales come in around €142m and media around €61m. Gross profit margin has now been declining at least for the last three years from 40.22% in 2021 to 36.44% in 2022. Management state the cause as the business mix shifting toward lower margin consumer electronics but, as we know from my other research updates, this is common and more price competition is not going to help.

Management also reported investment in growth, which in addition to the declining gross margin has put further pressure on the profit line. The number of employees rose from 107 to 128 pushing up employment expenses 23.7% and other operating expenses increased 14.8% rising to €67.8m with increased marketing spend and higher logistics costs listed as the main drivers. All this meant an operating loss of €2.4m down from a €2.2m operating profit in the prior year. Higher depreciation / amortisation and the TRG write down (see below), helped push the net loss to €5m.

Rebuy’s original rationale for the TRG acquisition was to a) acquire the self-developed software and b) to gain direct access to the UK market. The purchase price was in the region of €2.3m and the deal transacted in July 2021. The 2022 accounts include a write down on the asset of €1.89m or, 81% of the purchase price. That’s pretty dramatic / aggressive depending on your observation point. So either the (technology) valuation was over-cooked, there’s been significant operational challenges since the acquisition and/or, the UK market conditions meant that direct access was literally just that, access, and nothing more, which feels likely with a €548k loss for the year.

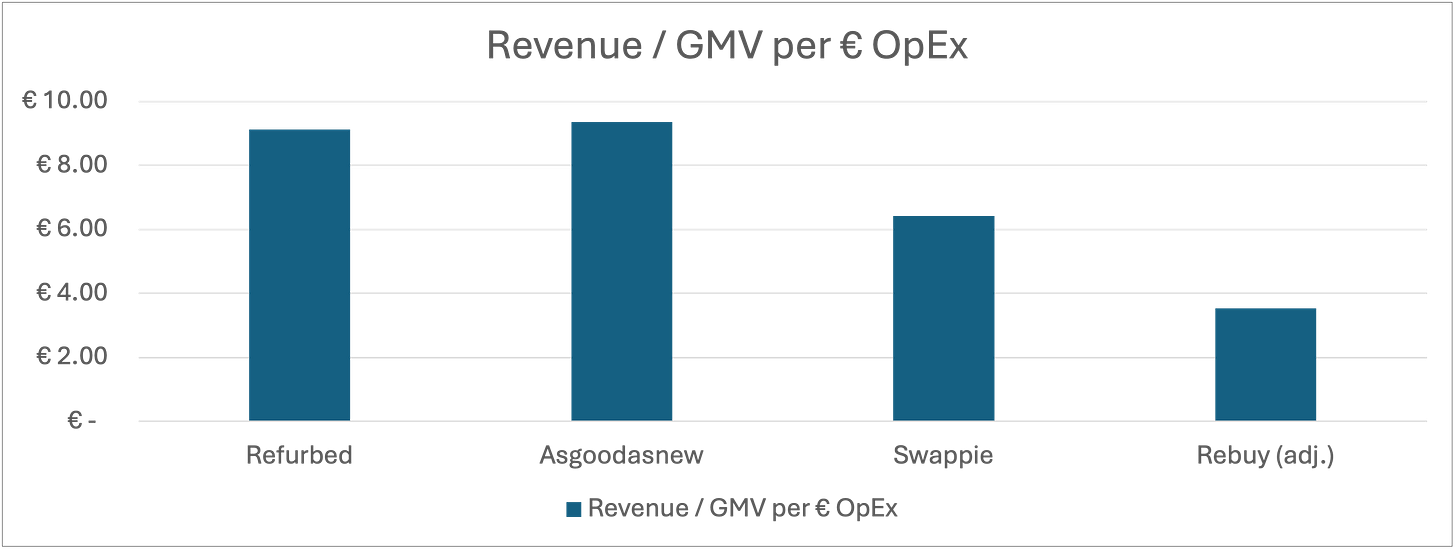

One obvious conclusion is that, even after adjusting for their exceptional items, it appears Rebuy have an opportunity to close the operating efficiency gap with their peers. I’ll be checking for progress on logistics costs, improving the cost of acquisition and inventory management when the 2023 accounts are filed.

So, whilst 2022 didn’t seem to be a particularly great year by the numbers, Rebuy look to be positioning themselves for growth and if their competitors are anything to go by, we should at least see further revenue growth in the next set of accounts.

In terms of approximate volume, let’s take 70% of the CE sales as mobile giving us 220k per year.

Refurbed

Refurbed are based in Austria and perhaps one of the best known marketplaces in Europe with operations spanning multiple countries. Unlike Asgoodasnew and Rebuy, Refurbed provide a true marketplace for sellers and buyers, along the lines of Back Market. Unlike Back Market, however, these guys file public accounts.

After a restructuring in 2023, there are several legal entities: including the holding company Refurbed GmbH; the main operating company, Refurbed Marketplace GmbH; Refurbed Direct GmbH for direct sales or acquisitions of devices and; Refurbed Plus GmbH for additional services which currently seems to involve insurance and extended warranties.

Looking across the entity restructuring, it appears that revenue grew substantially from €35m in 2022 to just shy of €61m in 2023 and looking at the commission structuring for sellers6, suggests a GMV of approximately €577m in 2023. That’s inline with EDCBs estimate7 of €570m.

A Gross Margin comparison with the other companies in this update isn’t relevant, but the cost base is: personnel expenses increased almost 21% to €12.9m and other operating expenses increased from €55.4m to €63.2m. The operating loss came in at €18.6m and the net result was a loss of €19.3m. So whilst the revenue (and GMV) is substantial, the cost base is unsustainable and given the founder announced a 20% reduction in workforce in February 20258, perhaps the 2024 result was not as good as management had planned for.

Whilst I’m not sure it was necessary at this stage, the entity restructure makes things neat and tidy. If you’re selling to Refurbed, it’s Refurbed Direct GmbH that’s buying. In 2023, the entity had a small operating footprint with only 5 employees, but enough cash to acquire a several thousand devices and inventory stood at €368k. Let’s use the average device value of €450, which suggests their holding 800-ish devices at any one time and shifting them quickly.

It would be nice to have some category data so that I could pin down mobile device sales volume. At the €450 average device value, GMV of €577m would equate to 1.28m devices. Clearly though, smartphones don’t account for all sales, perhaps 70% is a better estimate which gives us just under 900k devices.

One final thought is on the warranty offer. Whilst Rebuy back their product with a 3year warranty, Refurbed clearly have to take another approach. Instead, they offer an 18month warranty at around €30 and a 36month warranty at around €50. It’s hard to determine the level of sales, but there’s currently €1.25m of deferred revenue which I’m guessing is deferred over the policy lifetime. That suggests, and give me a bit of poetic licence here, there’s a total of 100-150k policies on the books, with an average 24mo lifetime, giving about 50-75k sales per year which on the back of the 1.28m devices would be an attach rate of 4-6%. I’d head to the lower end of that range. If we went for the 900k devices, the lower attach rate is just under 6%.

Swappie

Swappie is another ecommerce giant for refurbished devices with headquarters in Finland and, subsidiaries in Sweden, Estonia, the Netherlands and Germany. They’re also the only company (other than Back Market) to offer sales in the US. Swappie buy, refurbish and sell devices and offer a 12month warranty, which is bit leaner than their peers.

Sales in 2023 amounted to €207.3m, a very slight decline from €208m in 2022. There was a corresponding decline in gross profit of €3.1m, down from €44m to €41m which in percentage terms is 21.4% down to 19.9%, riding above Asgoodasnew (15.3%), but almost 17% lower than Rebuy’s which is down to the latter’s product mix (media having higher margins).

After an Operating Loss of €38.9m in 2022, management switched focus to efficiency over growth resulting in a significant staffing reduction (1266 to 818) and an associated drop in personnel expenses from €35.2m in 2022 to €24.4m in 2023. Other operating expenses were reduced from €44.6m to €33.3m and although depreciation and amortisation ticked up, the resulting operating loss was reduced to €19.7m. However, increased financing costs from issuing an 8% convertible bond in the summer of 2023 offset some of these savings, resulting in a net loss of €21.6m but still a significant improvement on the €39.7m loss the year before.

Quickly estimating the volume, a 100% mobile sales assumption using the €450 average phone price gives us 461k units and the more likely 70% gives us 322k units putting Swappie above both Asgoodasnew and Rebuy.

Despite management expecting low-double-digit growth in 2024, I’m assuming that the majority of other operating expenses are related to sales and marketing and with the level of reduction, I’m interested to see if sales have been maintained.

Strategic Implications

The analysis reveals several key strategic dynamics shaping the sector. While there's clearly strong revenue generation across the companies (that file accounts), profitability remains elusive. Management teams appear to be following one of two strategic paths: either preparing for growth (Asgoodasnew & Rebuy) or restructuring after unsustainable growth (Refurbed & Swappie).

The sector faces several structural challenges:

Price Competition: Once started, price-based competition is incredibly difficult to escape. With the general trade-in market becoming a battleground for OEMs, carriers and retailers9, device acquisition costs are likely to continue rising. Without clear differentiation, selling prices will continue to soften. However, companies that can build deeper relationships with OEMs, carriers and insurers may find some buffer against consumer price sensitivity.

Scale Economics: Despite significant revenue growth, none of these companies have demonstrated meaningful operational leverage. This raises questions about the fundamental economics of the business model. While some costs should scale efficiently (technology platform, central overheads), others appear to scale roughly linearly with revenue (refurbishment, logistics, customer service). This suggests that achieving profitability may require significantly larger scale than previously assumed.

Market Position: The sector appears to be facing a strategic inflection point. The pure marketplace model (e.g., Back Market, Refurbed) offers greater scalability but lower control over quality and customer experience. The integrated model (e.g., Swappie, Asgoodasnew) provides better control but requires higher capital investment and carries more operational risk. Neither model has yet proven definitively superior from a financial perspective.

Channel Evolution: Traditional retail channels are increasingly entering the refurbished space and being facilitated by technology platforms, while OEMs are expanding their own pre-owned programmes10. This creates both threats and opportunities - while it may compress margins, it also validates the market and could provide new partnership opportunities. Companies that can position themselves as valued partners rather than pure competitors may fare better.

Technology Investment There appears to be significant variation in technology investment across the sector. While all players have basic e-commerce capabilities, areas like automated testing, pricing algorithms, and inventory management show different levels of sophistication. Rebuy's write-down of their TRG acquisition suggests that technology integration and monetisation remain challenging.

Looking ahead, several factors will likely determine success:

Ability to secure reliable device supply at reasonable costs

Development of differentiated value propositions beyond price

Operational excellence in refurbishment and logistics

Strategic positioning vis-à-vis OEMs and retailers

Technology platform development and scalability

Working capital management and financial sustainability

The sector may also see consolidation as companies seek to achieve greater scale and operational efficiency. The recent AO.com acquisition of Music Magpie could be an early indicator of this trend, although at a valuation multiple nobody really wanted to see. Additionally, we may see increased specialisation, with some players focusing on specific device categories or customer segments rather than trying to serve the entire market.

For investors, the key question remains whether any of these business models can achieve sustainable profitability at scale. While the market opportunity is clear, execution challenges remain significant. The next 12-24 months should provide greater clarity as companies either demonstrate successful paths to profitability or face increasing pressure to consolidate. To extend the earlier analogy, perhaps they all just need to keep paddling for a bit longer, or buy a longer board.

Peace.

sb.

Hi everyone, please note that since this article was shared via Pieter Wasdoorp's secondary market news site, Recommerce would like to point out they "have always been transparent about our results, and announced a nearly 180M€ turnover in 2024, with a growth of 30% over the last years. We also stand out as one of the players with a positive EBITDA". Opaque or transparent? You decide. Fascinating. (https://www.recommerce-group.com/pour-ses-15-ans-recommerce-annonce-175m-de-chiffre-d-affaires-et-une-croissance-de-15-en-2024)