Insurtech startups have consistently turned me off. The confidence to change the way insurance does this or that more often than not turned out to be hubris or financially unsustainable - insurance losses are not an investment. I’ve only ever invested in one insurtech which, after an early pivot to sharply narrow their focus, has continued to quietly gain clients and experience, sans hubris. The hype around “embedded 2.0”1 seems to me just another buzz, proponents of which have conveniently forgotten about the rapid unbundling of affinity insurance (embedded 1.0?) before insurtech was even a glint in the eye of fintech’s spec on the horizon.

So, it’s with an unhealthy dose of scepticism I research startups in the device protection / lifecycle sector, especially ones that I can’t quite pin down strategically or especially financially. Bolttech is one of those that came guns blazing into Europe several years ago with a funky repair / upgrade programme with some T&C’s that did an awful lot of work. But, with a recent $2.1bn valuation after raising $100m in a Series C round led by Dragon Fund2, I’m hopeful they’re on track for some substance.

I am forced, however, to focus this update on Bolttech’s European entities. I’m almost at the point of giving up on finding recent3 topco information at the Singaporean registry and anyway, I think the actual topco is based in the Cayman Islands, that bastion of financial transparency happily facilitated by the Treasury wonks at HMG.

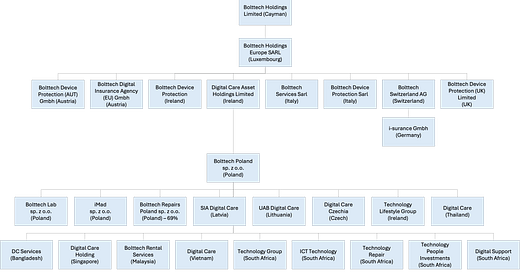

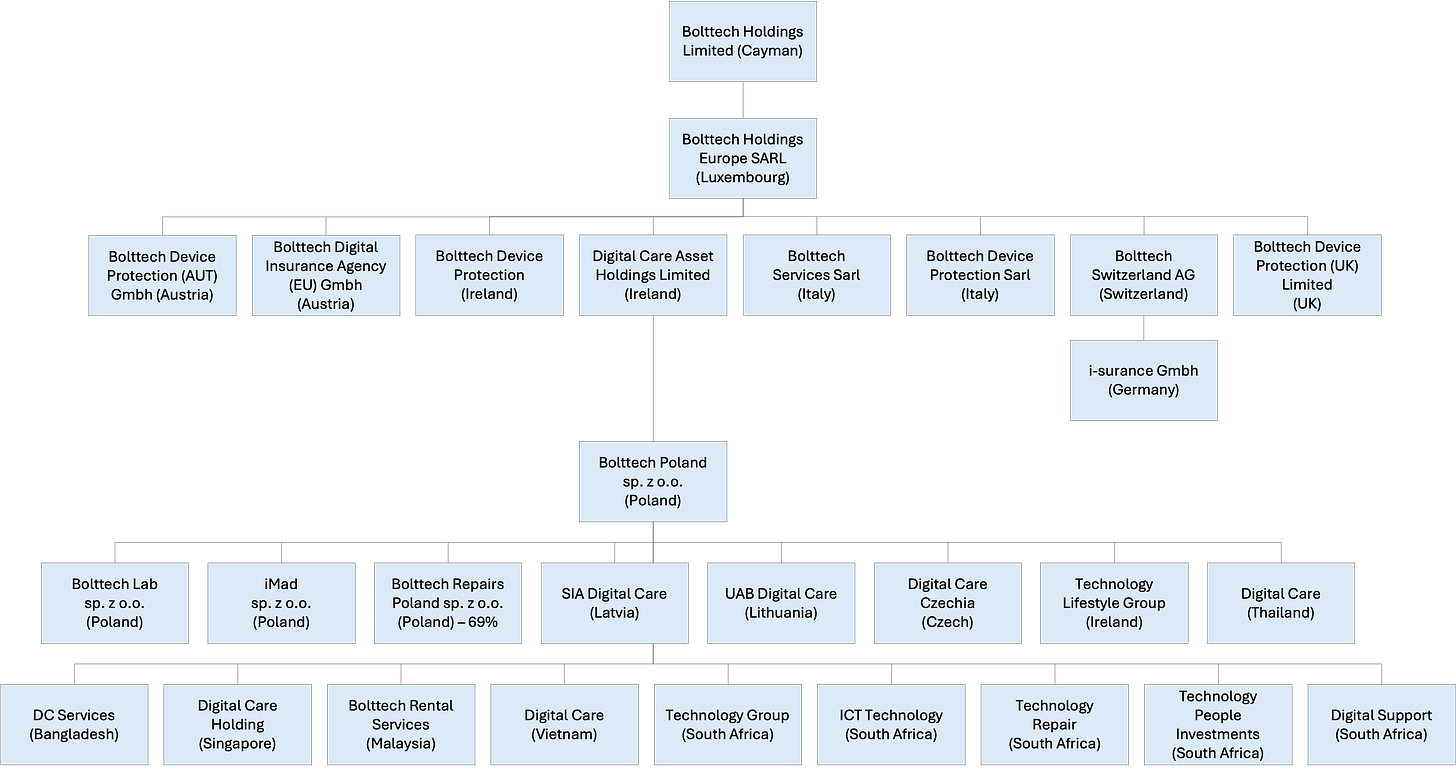

Boltech’s European topco is based in Luxembourg which, as at the end of 2023 had nine subsidiaries: two in Austria, two in Ireland (one with additional subsidiaries in the EU and beyond), two in Italy, and one each in Switzerland and the UK, along with a whopping great balance sheet of €219m, 88% of which are the subsidiary investments. The remaining subsidiary was based in Luxembourg and recently liquidated.

Austria

After the Italian repair / upgrade thing in 2019, Bolttech launched a similar "switching” service with Drei, Austria in June 2020, subsequently discontinued4 and then announced the launch of their first device protection programme with Drei in January 2021, underwritten by AIG Europe. In November the same year, they launched another protection programme with MTEL, an MNO which again is underwritten by AIG.

Financial information is limited and according to the registry requirements, both Bolttech entites must therefore have two or more of: a balance sheet smaller than €5m; revenue below €10m or; fewer than 50 employees. According to the most recent filings for the year ended 31/12/2023, Bolttech Device Protection (AUT) GmbH, acting as an administrator posted:

A negative equity position of €5.8m which had deteriorated from -€3.5m the previous year

Total assets of €1.27m

Liabilities of €6.73m

For the same year end, Bolttech Digital Insurance Agency (EU) GmbH, acting variously as a group policyholder and an administrator, posted:

Negative equity of €1.77M down from -€1.38m the previous year

Total assets of €2.05m

Liabilities of €3.54m

Whilst not specified, it’s highly likely that the liabilities are owed to the group, so that’s less of an issue. But, it’s certainly clear that operations are pretty tough and after four years of giving it a go, a path to profitability remains elusive. Now, that said, there might be factors which are not documented and group management may be happy to run up local losses with continued parental support. Personally, not my cup of tea.

Ireland

In December 2020, Bolttech announced a programme launch with Three Ireland, for device protection. It looks like Bolttech Device Protection (Ireland) Limited was incorporated just a few months before and has filed one set of accounts since (that I can see) for the year ended December 2020. So that’s not much use. Now, I think there’s a filing exemption for entities having an EEA parent that provides a guarantee over the subsidiary’s liabilities. So maybe that’s the case here given that Zurich took over Three’s insurance programme sometime the following year.

With only the Luxembourg holding company filing to go on, all I can report is that as of December 2022 the negative equity position stood at €5.1m with a loss of €2.56m in the year.

Bolttech’s other Irish entity came along with the 2023 acquisition of Warsaw-based Digital Care Group5 whose holding company, Digital Care Asset Holdings Limited is based there. For those with a good memory, bolttech has acquired what Regenersis disposed of and rebranded under the Blancco Technology Group who subsequently sold on to Mazovia Capital a small cap PE firm in Dublin6 who I think trundled off to the bank quite happily.

Poland

Now at this point, I have to admit to my understanding of Polish and Polish registry requirements being nil. However, it appears Bolttech have acquired something of substance, at least based on the 2022 financial statements. Digital Care Group posted group sales of €42m up from €38m the previous year. 81% of revenues came from the sales of service programme support, 8% from sales of insurance program support and the remaining from sales of goods and other services. Net profit came in at approximately €5.9m.

Timings are a little off but, going back to the Luxembourg accounts it appears that bolttech acquired Digital Asset Care Holdings for a little under €166m which, means an approximate Price/Earnings ratio of 28x and looking at the balance sheet, about a 4x Price/BookValue and an 18.4x EV/EBITDA multiple.

Now, I don’t doubt the strategic value of the asset, especially to an organisation that’s stated their expansion aims and struggling in some European markets, but that’s some multiple. Ingram Micro’s worked out at about 7.2x at the IPO and Apple trades around 21x. It’s entirely possible I’ve got that purchase price wrong and I’m always happy to be corrected, but if not, it’s a good job they’ve convinced a bunch of VC’s with deep pockets because it’s not hard to imagine a queue of founders waving term sheets outside that brassplate in the Cayman Islands.

Italy

I first noted Bolttech entering Europe back in 2019 with the aforementioned phone repair / switch product that had some customer terms and conditions doing some very heavy lifting. That product subsequently morphed into Wind Tré’s current Reload product with a few more pages of T&Cs added as of March last year. As I understand it, for an additional fee alongside your carrier plan, you can switch your device twice for any reason in the first 12 months and then once every 6 months thereafter. There’s three tiers of devices, a service and activation fee, and a one-time switch fee which increases for premium phones7.

So how does all this translate into performance? Bolttech Services (Italy) S.á.r.l. primary purpose is to provide consultancy, managerial and business development services, launch planning and operational support for group companies. Revenue declined to nil in 2023 with an associated loss. It’s entirely possible that management have taken a new approach to structuring operations and this entity is no longer required.

Programme revenues flow through Bolttech Device Protection Italy S.á.r.l. and it looks to be doing well. Revenue increased from €17.5m in 2022 to €23.6m in 2023 that’s a decent 35% jump. Management commentary tells us that device sales from trading grew as did the service fees and revenue from the Wind Tré Reload programme due to an increase in the customer base and a shift towards higher priced plans and phone bands. Associated profits grew alongside from €1.62m to €5.25m. Good news.

So taking what we know about revenues and programme fees and applying a few averages, a reasonable range for the Wind Tré Reload customer base would be 300k-400k subscribers, with around 13,000 switches taking place annually, a rate of around 3-4%.

Switzerland

In July 2021, bolttech acquired Berlin-based i-surance for €21m via its Swiss holding company which subsequently became Bolttech Switzerland AG. The deal came along with the retail device insurance programme for the Digitec Galactus group and a carrier programme with Salt (formerly Orange and Switzerland’s third carrier by subscribers). That relationship recently moved up a level with Bolttech announcing preferred partner status for device insurance with the parent NJJ telecom group for the European mobile operators under its portfolio8. Ultimately the objective must be to increase volume by going even further up the chain to the Iliad group operators including Free in France.

Despite the limited financial information available from the Swiss registry, the entity (i-surance > bolttech) appears to be performing well relative to the other European subsidiaries. Net equity improved from CHF 7.17M to CHF 7.70M in 2022 although profit declined from CHF 1.08m profit in 2021 to CHF 262k in 2022. I’ll be keeping an eye out for the 2024 filing and update as soon as I can.

UK

Again, there’s limited information as it relates to Bolttech Device Protection (UK) Ltd due to it’s size. UK company registry requirements mean the Bolttech subsidiary must have turnover of less than £10.2m, a balance sheet smaller than £5.1m and fewer than 50 employees. So, all we have to go on is a balance sheet showing assets in 2023 of £950k, inter-company creditors of £16.2m and accumulated losses of £16.5m.

According to the balance sheet, the UK entity made a loss of £7.2m in 2022 and a further loss of £4.9m in the year to 2023. Now, given that trade creditors has just dropped to zero and I’m assuming that the entity is providing group support to the other EU companies, as well as opportunistic UK business development.

Interesting to note that Richard Li (Tzar-Kai) has been listed as a person with significant control since the entity was established in 2019, long before his Pacific Century Group investment vehicle took a stake at the Series B raise in 2023.

Summary

The European results are clearly varied, with Italy performing well, Austria, Ireland and the UK with more to do (depending on their purpose). The i-surance acquisition (Switzerland / Germany) has brought along a couple of brands, but there’s no indication of scale yet. It’s too soon to judge the acquisition of Digital Care, but it’s meaningful. Still, with only 8% of revenues from insurance programmes, it feels like there’s some upcoming work to shift strategy and align it more closely with bolttech’s purpose and rationalise the organisation structure.

The sector needs healthy competition, especially from innovative organisations that can rapidly develop consumer focused products. But I’m not seeing too much of that from Bolttech in Europe, they appear to be following a fairly traditional route of carrier/retail relationships that take time/capital and an awful lot of patience (including a few renewal cycles) before you can extract the value.

Until I find larger revenue streams, either in the US or Asia, I remain sceptical about that $2.1bn valuation. The Digital Care acquisition at approximately 28x earnings and 18.4x EV/EBITDA suggests an aggressive growth strategy that will require significant execution to justify. While the Italian operations show promise and the Swiss business provides strategic (but how large?) opportunities through the NJJ relationship, the continued losses in other European markets raise questions about scalability. The recent rating report from Fitch9 regarding the Hong Kong entity didn’t provide me with enough evidence of scale to change my mind much either.

With the possibility of MTR Group being available in the UK, I could imagine it being an attractive target for Bolttech’s management, though more along the lines of Digital Care Group rather than an insurance play. That said, I’d be wanting to prove I can transform the recent acquisitions in-line with Bolttech’s value proposition before getting the wallet out again.

Bolttech's path to profitability in Europe, outside of Italy and potentially Poland through Digital Care, remains unclear and appears to rely heavily on continued parent company support so I’m sincerely hoping the VC’s along with their gushing announcements10 have put in the work to figure out if the door was bolted before or after they chucked their funds into the stable.

Peace.

sb.

The most recent information I can find is from 2018.

Discontinued in October 2022: https://www.drei.at/de/privat/produkte-und-services/drei-direkttausch/