Asurion Europe Limited (06568029) and Asurion Soluto Europe Limited (10163748) both filed accounts for the year ending 31st December 2023 on 24/09/2024. Thankfully the entities’ accounts are pretty straightforward and include a decent set of notes that offer some strategic insights as well as the usual financial ones.

It’s fair to say that, at least in terms of the filed accounts, Asurion has struggled to make an impact since establishing an entity in 2008 and I believe that Tesco Mobile is the only remaining account since SquareTrade won the H3G account in 2019/2020.

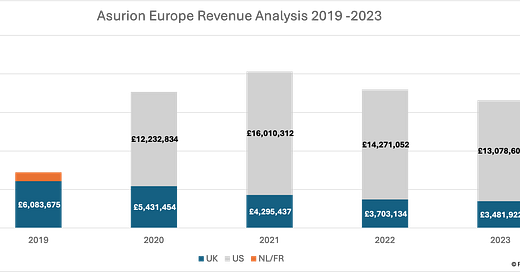

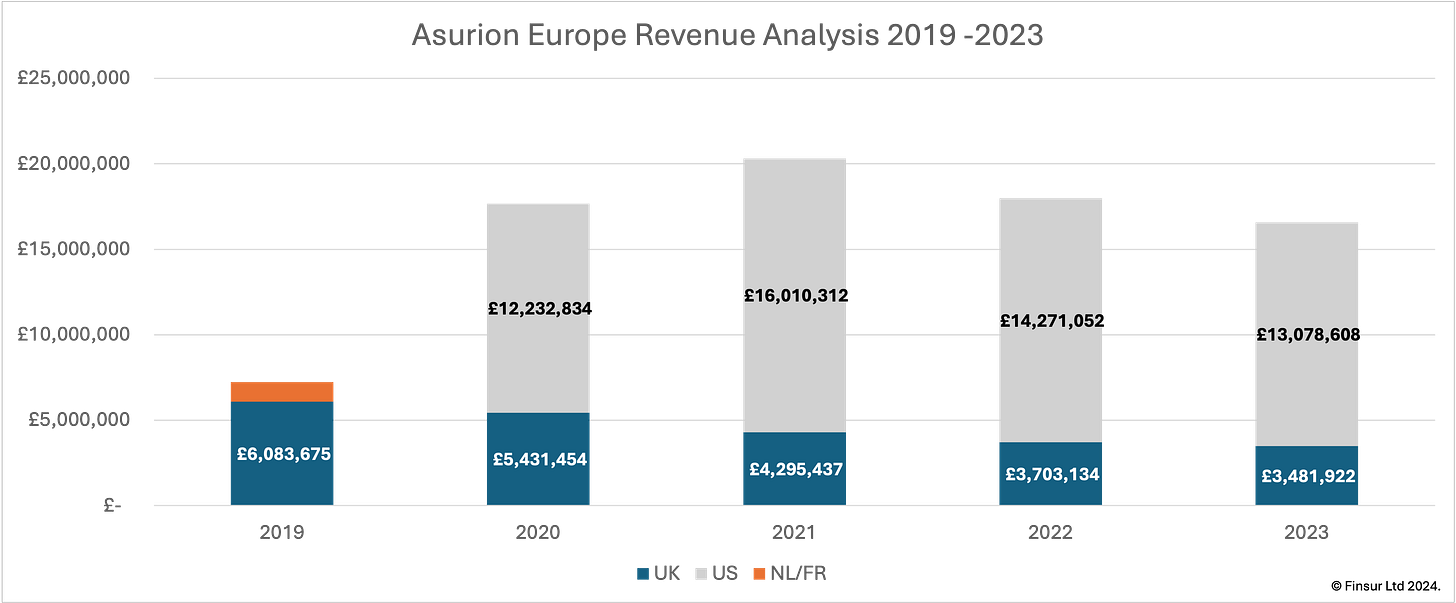

As usual, the analysis period is the last five years and since 2019 Asurion’s UK revenues have declined almost 43% to £3.48m in 2023. This is also down YoY 6% from £3.70m in 2022. H3G runoff may account for some of the YoY decline which means is still a bit tricky to gauge the Tesco Mobile performance.

Since 2020 the UK entity has received a revenue bump from a “licence income” provided by Asurion LLC (the immediate parent) under the terms of a marketing support agreement. This has accounted for 79% of revenues for the last 3 years and 69% in 2020. Hard to see this as anything other than an efficient use of the £27m (un-recognised) deferred tax asset and a gnawing away at the £171.8m loss on the balance sheet.

Asurion Soluto Europe Limited is the entity for delivering Asurion’s advanced technical support capability in conjunction with device protection programmes. Outside of the original UK business which ended in 2020/2019 and the Dutch business in 2018, there’s been very little activity besides a pilot scheme with an Italian telco in 2021/2022.

So what to make of all this?

Having struggled to maintain a strong foothold in the region, it’s hard to see Asurion growing anytime soon. I struggle to believe the parent is going to throw additional investment across the pond, unless there’s some guarantee of a sizeable new business win. That maybe a little unfair, they’ve successfully kept the Tesco Mobile business for a while now. Ultimately, how Asurion competes (on price 👀) for future business may come down to the value of that deferred tax asset within the wider group or the impact of having to write off that balance sheet loss.

I know that the provision of technical support services has been high on the product development list amongst device protection providers for some time. I think Asurion’s experience with Soluto, at least in Europe, gives a pretty good steer on what to do if you’re thinking about investing in this area. After you’ve solved your parents’ [insert applicable device here] issue for the [insert applicable integer here] time this month ask them how much they’d be willing to pay for tech support. Nothing. So provide the service to reduce NFF claims by all means, but don’t bother with the bells and whistles, because nobody wants to pay for it. Asking your kids to help out is way cheaper.

Peace.

sb.