Alchemy Telco Solutions Research Update

Turning yesterday's tech into tomorrow's gold is way too obvious for a byline...

Back in October, Alchemy Telco Solutions announced a significant 41% increase in processed devices and an even more impressive 61% increase in FY2024 revenues over FY2023. In my October monthly Round Up1, I promised a dig around after their 2024 accounts were filed. So, here we are.

Recap

Alchemy Telco Solutions was incorporated in Ireland on 6 January 2017. On 12 January 2018, Macquarie came in for a 45% stake with Hong Kong based Enviro Management Consultants (“EMC”) retaining a 55% share. Macquarie remained the ultimate parent and controlling party until April 1st, 2019. The early exchange of revenue, expenses and consultancy fees between the three organisations suggests a well organised joint-venture from the outset. I can imagine this all being planned out by the ex-Brightstar team (EMC) and the Macquarie guys over a few beers in SoHo or Lan Kwai Fong. That’s complete supposition by the way.

The stated principal activities of the business haven’t changed much since incorporation, now being “engaging in smart device trading and collections business”. The directors haven’t changed around much either with Gary Noone (EMC), Walter Vicente (EMC), Kevin Doherty and Lou Tricarico from Macquarie being on the on the Irish entity’s director slate since 2019. In addition, James Murdock (EMC), also a founder has been part of the management team since inception and is a director of the UK entity.

There was an early acquisition in 2019 of MobileReclaim in the UK, along with the establishment of Australian, Hong Kong and US entities. Given the €100 consideration, I’m not sure if Loop Mobile (Ireland) was an acquisition or just a paper exercise for something intentionally established by management. Along the way there’s been a trading entity established in Hong Kong and another in Japan. Most recently there’s been an entity set up in Dubai2 and the acquisition of the Australian MVNO, numobile3, although I suspect the thesis was more around their device-as-a-service technology as opposed to the native MVNO capability.

Performance

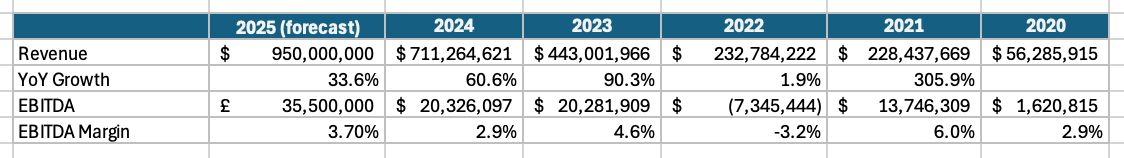

From the outset, revenue development has been impressive, and Alchemy were recognised again this year (for the second time) in the FT1000 list of Europe’s fastest growing companies4. How much of the early growth was due to the Macquarie relationship is moot. Management identified an opportunity and have been seizing it ever since. Good stuff.

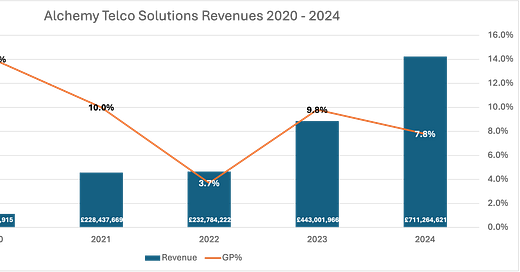

For FY2024, Alchemy posted $711m in revenue, an increase of 61% over $443m in FY2023. Over the 5-year analysis period (2020 - 2024) the CAGR is 89%. Management provide no specific commentary related to revenue progression, but the associated press release in October, noted the US and JAPAC regions as making a significant contribution to the result5. As things stand in FY2024, the Republic of Ireland contributed 0.3% of revenues, the United Kingdom 8.3% and the Rest of the World, 91.5%.

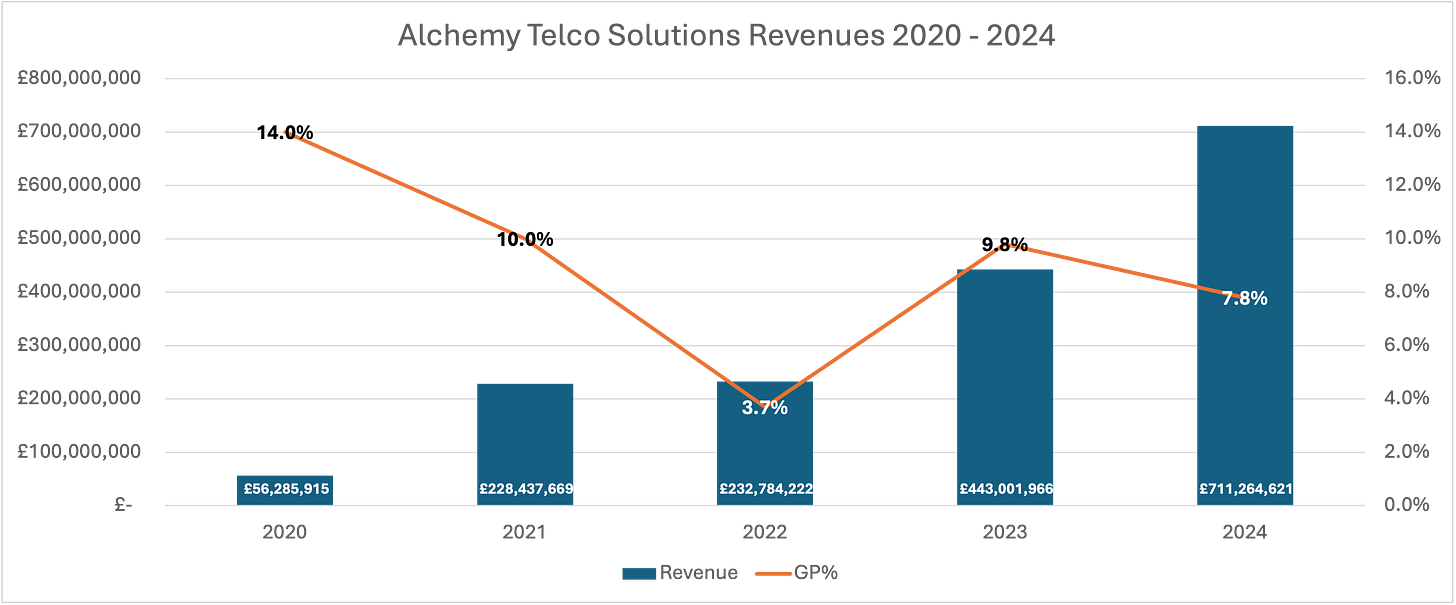

I’m not able to disaggregate the Rest of the World revenues any further due to filing limitations in Japan and the US. However, management provide profit analysis by entity, so we can get some notion of regional top-line contributions.

I say “some”, because there’ll be too much going on - inter-company transactions, adjustments and eliminations, different accounting bases and forex in addition to operational activities like central management of group buying and selling, inter-company licence fees for technology and centralised treasury - for us to directly correlate subsidiary revenue to profit performance. However, Alchemy’s key partner list: Apple, Verizon, T-Mobile, Amazon, Back Market, Samsung, Best Buy, Telstra, CDW, Walmart, eBay, Asurion, Swappie and Assurant puts the volume firmly in the US.

Regarding profitability, simplistically, gross profit appears to be following the industry norms with continued pressure over the analysis period. However, given the significant revenue (and inventory growth - see below), margin trade-off to build market share and scale is probably having an additional impact.

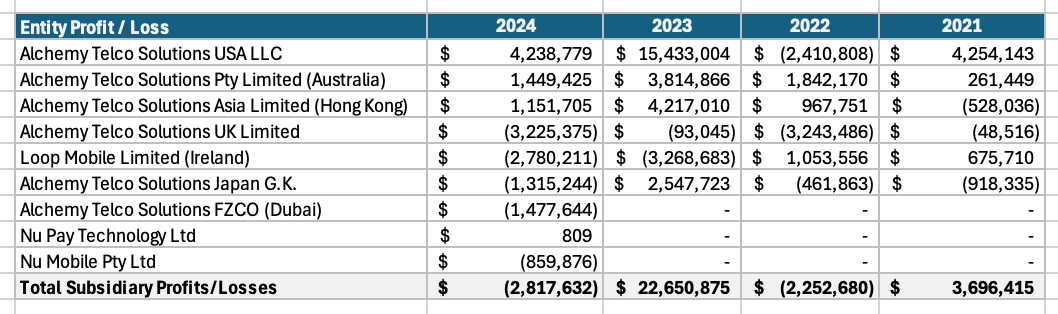

Deteriorating gross margins are obviously going to put pressure on the rest of the income statement, but it’s worth looking anyway. EBITDA remained essentially flat from last year at $20m after a substantial improvement from FY2022 to FY2023. The primary reason for the limited profit growth seems to be the administrative expense line which as a percentage of revenue declined, but in real terms rose by almost $10m. Key drivers of this appear to be the additional staff numbers, which increased from 160 in 2023 to 222 in 2024. Still, if we were to use that old favourite start-up metric of revenue per employee, it’s a tad over $3.2m. Not too shabby.

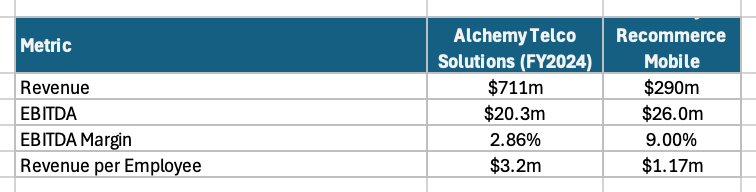

Finding comparisons in this sector is not easy due to the scope of operations most companies cover. However, I thought it would be reasonable to put Alchemy and Foxway’s Recommerce Mobile business unit side by side:

But now I’m looking at it, I think the timing is possibly a bit unfair. Alchemy are clearly in growth mode, whereas we know Foxway began their pivot towards profitability when Nordic Capital told them to. Alchemy will be more volume driven versus Foxway’s focus on extracting maximum value, cost control and increased automation. So perhaps give Alchemy another year for either additional volume growth from the same cost base, and or, a bit of cost rationalisation and the comparison might become more applicable.

Financial Position

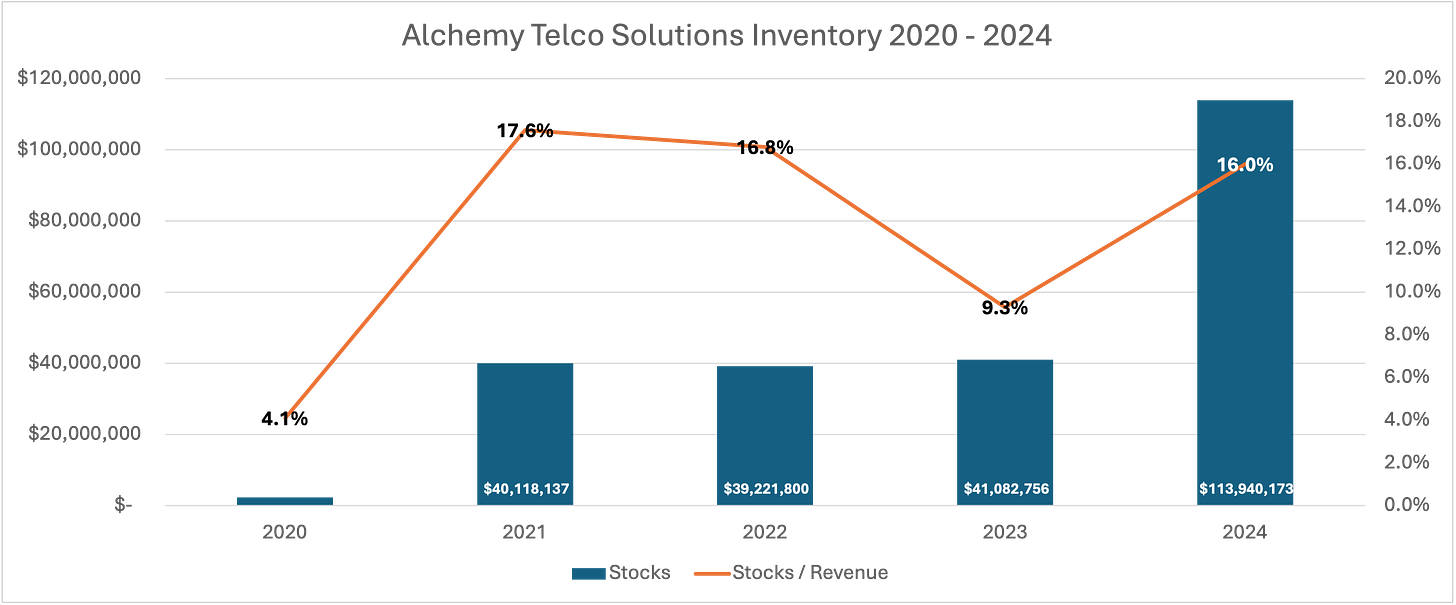

You don’t need to look too far down the balance sheet before the increase in stocks (inventory) will make your eyes water. If you then follow the accounting note and look at the inventory write-offs, you might want to get the tissues out. Excluding write-offs, inventory rose from $41.1m in 2023 to $113.9m in 2024, that’s a 177% increase. It’s a bit blunt, but let’s say the average device value is $480, they’re getting close to 250k units in stock.

Write-offs rose from $6.6m in 2023 to $11.6m in 2024. To put that into perspective, that’s a little over MTR Group’s total 2024 inventory. In absolute terms though, the 2024 write-off, at 9.2% of total stock is lower than in 2023 at 13.9%.

Despite spending all those dollars on phones, Alchemy’s cash position continued to improve after a dip in 2022. Cash for FY2024 was at $27.9m up from $22m in 2023, a 27% increase. Despite the current ratio deterioration from 1.31 in 2023 to 1.24 in 2024, the liquid nature of devices and the credit risk mitigations on collections, probably means they’re in a stronger position than the quick ratio suggests, which at 0.37, from 0.63 in 2023 might normally be getting the finance (risk) team’s collective pulses racing.

One final observation on the asset side of the balance sheet is the relationship between prepayments and stocks, which may give us some indication of the supply chain dynamics when building this type of scale. Since 2021, prepayments as a percentage of the following year's inventory have ranged from 7.9% to 12.9%, suggesting a relatively consistent forward-looking investment required to secure device supply. The dramatic increase in prepayments during 2023 ($10m) telegraphed the large inventory buildup we subsequently saw in 2024. The pattern suggests that if you want to scale in the secondary device market, securing future supply requires significant advance commitments.

What's particularly interesting is that the 2024 prepayment figure of $7.8M (down 22% from 2023) might predict a more measured approach to inventory expansion for 2025, possibly indicating a shift from aggressive scaling to more efficient inventory management, freeing up working capital. The evolution in working capital dynamics could be a key indicator of the business transitioning from pure expansion mode to a more balanced approach focused on profitability and return on invested capital. Further supporting an improved EBITDA comparison next year.

As you might expect, building up the inventory like that over such as short space of time has come at the cost of (mostly) short-term funding. The credit mix shifted about a bit, with loans from credit institutions increasing from approximately $16k in 2023 to $29.1m in 2024, debenture loans of $10.6 million were added in 2024 (none in 2023), convertible loans ($8.0 million in 2023) were fully repaid in 2024 with total credit liabilities increasing from approximately $16,343 to $39.8 million. Some shift.

Despite the increase in borrowing, interest payments decreased from $5.3m in 2023 to $3.7m in 2024 suggesting more favourable terms on the new debt, possibly refinancing of existing debt and or different timing of debt acquisition during the year. In addition to the bump in credit, suppliers played their part in funding the expansion with trade creditors increasing from $43.8m to $75.8m.

Overall, the short-term credit structure became a bit more complex than in 2023, but there’s probably more flexibility as Alchemy have shifted toward a higher leveraged model.

Cashflow

I think it’s safe to say that the major cashflow related points are associated with the increase in inventory and the changes in funding structure to get there, all covered above. The only other noticeable event from the cashflow statement is the acquisition on numobile in Australia for $1.4m.

Outlook

With their recent investments increasing operational capacity in the US and Dubai, alongside Callisto, their wholesale trading platform, Alchemy have placed significant bets on organic growth. In terms of volume, the new sites add capacity for over a million devices per year. The 177% year-over-year inventory increase from $41M to $113.9M isn't just big, it feels more like a strategic bet suggesting they're playing a different game than some competitors.

Regular readers will know that my general view is that the secondary market must consolidate. Alchemy's approach to consolidation appears to be by acquiring as much stock as possible. Same effect. But, securing supply has come at some short-term cost, specifically to both working capital and margins. This is what you'd expect when a company is prioritising market share and supply security over short-term profitability.

It's worth noting that Alchemy's own commentary6 acknowledges the market realities: "margins are under pressure" and "sourcing quality devices at competitive prices is getting tougher." They've built "trade-in infrastructure for scale," but they still need a bit more time to test that hypothesis and overcome the fundamental margin challenges in a market where, as they put it, "residual value is king".

Readers of my Foxway Research Updates78 will know about my predictions, however, just for kicks, and absolutely not any sort of guidance whatsoever, here’s an estimate for Alchemy’s FY2025:

Growth Rate Approach: The growth rate has been decelerating (305.8% → 1.9% → 90.3% → 60.6%). A conservative estimate would be 30-40% growth for 2025.

Inventory-Based Projection: The 177% increase in inventory suggests confidence in significant revenue growth, but likely not at that same percentage. Using inventory as a leading indicator, 40-50% growth seems plausible.

Industry Comparison: Foxway experienced slower growth, suggesting a potential moderation in the circular tech industry.

Balancing these factors, I predict 2025 revenue of $925-975 million, representing approximately 30-37% growth over 2024. Not quite over the $1bn mark, I’d give that another year.

EBITDA margins have fluctuated, with recent years showing compression. The compression in 2024 despite revenue growth suggests:

Higher cost of sales due to strategy, inflation and supply chain challenges

Increased administrative expenses as the company scales

Integration costs from acquisitions

However, inventory build-up and scale advantages should help improve margins in 2025. I expect EBITDA margin to improve slightly to approximately 3.5-4.0%. Therefore, I forecast 2025 EBITDA at $32-39 million.

It’s interesting that Alchemy has an “Investors” tab on their website. I’d suggest this is aimed at private equity. Perhaps there’s company out there wanting to follow in Nordic Capital’s Foxway footsteps, although I’m less sure the traditional LBO approach is appropriate here: the cash flow demands of servicing high debt levels conflicts with the working capital needs of the business, limiting possible responses to market opportunities and any future gross margin compression.

Private equity firms interested in this sector would be better served by employing more flexible capital structures that preserve liquidity while still offering attractive returns on investment. The refurbished device market sits at an interesting crossroads - environmental regulations and sustainability initiatives create tailwinds, while margin pressure and increasing competition are generating significant headwinds.

Alchemy's bet on scale and inventory acquisition is bold, and may well prove prescient. Their focus on building trade-in infrastructure and multi-channel recovery, positions them strongly for an industry that's moving toward consolidation. If they can leverage their expanded operational capacity while optimising their inventory strategy, there’s a real opportunity to emerge as a winner. The margin challenges are real, but so too is Alchemy's demonstrated ability to adapt and grow through varied market conditions, something their 5-year financial trajectory makes clear. For those of you looking to benchmark your own or other trade-in organisations, Alchemy seem to be laying out what’s possible.

Finally, whilst I recognise the transparency afforded by management in the accounts, is aimed at potential investors and not me, I am grateful for the clarity with which the accounts are presented.

Peace

sb.

Thanks for sharing, very detailed information.

Have a question on the below part on write-offs. Are these write-offs old phones that no longer have re-sale value? How does a company mitigate the risk of write-offs? Is it an issue that they are unable to offload old stock in their inventory or they purhcased a bulk of phones that came with a mix of profitable and unprofitable “write-off” models?

“Write-offs rose from $6.6m in 2023 to $11.6m in 2024. To put that into perspective, that’s a little over MTR Group’s total 2024 inventory. In absolute terms though, the 2024 write-off, at 9.2% of total stock is lower than in 2023 at 13.9%.”